How to calculate credit card interest? How do you calculate monthly interest on a credit card? What is the formula for interest on a credit card? Convert annual rate to daily rate. Determine your average daily balance.

For example, you can make payments to your credit card account as soon as possible, rather than waiting until your payment due date. If after calculating the total amount of credit card interest you will pay, you feel overwhelmed or like you are drowning in debt, don’t panic. If you have good credit , you will be offered a lower APR and if you have an average or poor credit rating , you can expect a higher APR. The amount of your next payment that will be applied to interest. First, you could look into transferring your balance or balances to a new card with a interest rate , which could help you pay off the card without making those monthly interest payments.

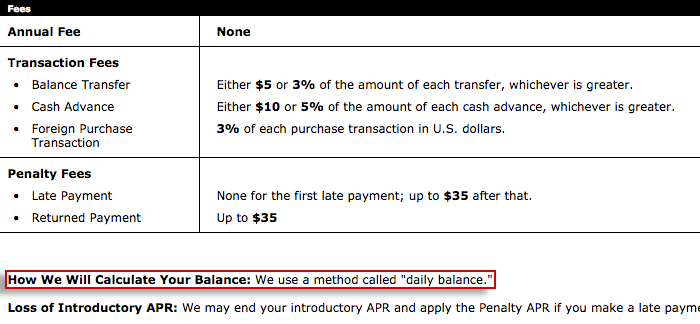

Of course, most cards with a introductory interest rate charge a fee for the balance transfer — usually to. But before you run full steam ahead into applying for any credit card , it’s absolutely critical that you understand credit card interest , how it is calculated , and how you can avoid having to pay it. You know those pages and pages of fine print that your credit card company sent you when you first got your credit card?

You would have residual interest billed on the next statement. This would be the interest accrued between the statement closing date and the actual date payment was received. There are a couple ways you can calculate interest it just depends on what you have. If you have a financial calculator you can calculate interest but it take a couple of calculations. Multiply each DPR by the number of days in the month.

Calculate the DPR for each tier. Add the amounts together to find your. This number will vary from card to card and person to person depending on factors such as credit scores. Your APR is expressed in terms of a year, but credit card companies use it to calculate charges. Find out the difference in interest between a fixed payment and the minimum credit card payment with bankrate.

To figure out how much interest you owe in a month on an unpaid credit card balance, the credit card company uses your average daily balance. This amount is average because credit card balances tend to fluctuate over the month as you buy more items and make payments. Many credit card companies calculate interest using a method called “average daily balance. Basically, at the end of each day in a billing cycle, the credit card company writes down your current balance (if you have a grace perio new purchases won’t be included in that daily sum). For credit cards, this is calculated as your minimum payment.

Your monthly payment is calculated as the percent of your current outstanding balance you entered. Many Canadians are unsure of how credit card interest works and how quickly it can add up. That’s why we built a credit card interest calculator – so you can take the guesswork out of saving money on interest.

You can work it out by adding up your balance on each day and divide by the number of days in the month. Average Daily Balance: The average balance in your account for a month. Just enter both your Balance and APR ( ) numbers below and it will auto-calculate your daily, monthly, and annual interest rate. This is the most accurate way to figure out your interest because,. Though APR is expressed as an annual rate, credit card companies use it to calculate the interest charged during your monthly statement period.

The repayment calculator analyzes your monthly payments, interest rates, and over all debt. Use the credit card repayment calculator to determine how long it will take for you to pay off all of your debt.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.