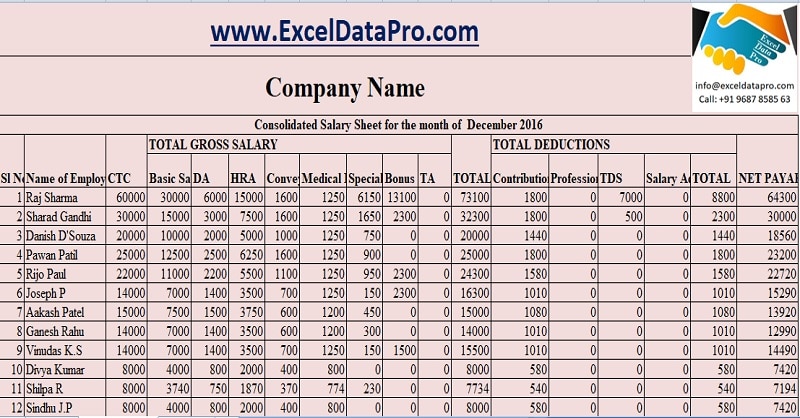

We can calculate the basic salary of an employee if we know the PF contribution. A salary sheet or Employee sheet is the Payroll or Human Resource document used to calculate the salaries of employees in any company. This is automated Salary working file.

Note: Enter whatever is available in your offer letter, do not worry about the missing components. Some components PF, Company contribution to PF, Insurances etc aren’t included in the excel sheet , they aren’t a part of monthly salary. During the month A have taken days leave from the working days of 26. Now you can calculate your income tax as follows: 1. Add a Differential column right to the tax table. In the Cell Dtype , in the Cell Dtype the formula =C7-C and then drag the AutoFill Handle to the whole Differential column.

Add an Amount column right to the new tax table. His actual salary is Rs. Hence, his PTAX deduction shall be be Rs. Assume he goes on loss of pay for the whole month, his salary will be zero and hence there would be no deduction. Therefore, it should be based on the earnings only.

How do you calculate wages in Excel? What is the formula for calculating salary? How to create a balance sheet with Excel? Salary Sheet Excel Template is a payroll document in which you can record payroll data for multiple employees along with Salary slip.

Excel multiplies your salary in cell Aby the number of pay periods in one year to calculate and show your annual salary in cell A2. This Salary Format is very useful for calculation of salary for various Employees. Download Various HR Formats from this Site. By Using this file you may calculate Day wise Salary Automatically.

Create a new workbook in MS Excel and save as with the name Employee Pay sheet Formulas. Enter sample data for at least three employees. There are tabs in the excel sheet – One yearly and One monthly. In case of a small organization with few employees, this can be maintained in the excel template. This attendance sheet in excel with formula will help in leave and attendance management of employees with visualization dashboard.

Excel returns “$6000” as your annual salary in cell A2. I found really good information from your site, however I need more functionality which will also calculate any deductions on a staff member and reduce it from the final pay. An want salary sheet sample in excel for creating a Fake or copy sheet , so download our sample and create your summary accordingly.

Furthermore, you just need to stamp this sheet or signed by some authority or Grade officer for the legal document. PF, (960) Other accts 780. Salary Calculation Template GROSS – Cost to Company Rs. Now calculate total of tax amount in cell F13: =SUM (C13:E13). In general, when staff have been working in a company for a year, they will deserve their annual leaves.

And maybe the days of annual leave will be added with the working years. But if there are hundreds or thousands of staff in your company, how could you quickly calculate their own annual leaves.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.