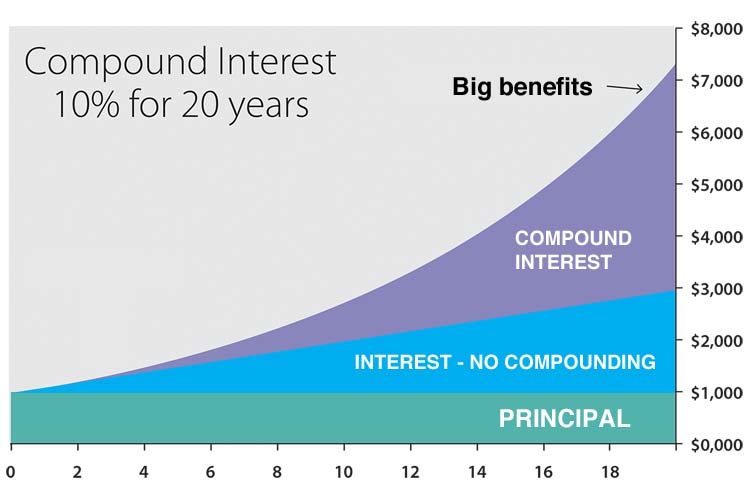

Compound Interest Formula. It is the basis of everything from a personal savings plan to the long term growth of the stock market. Determine how much your money can grow using the power of compound interest.

Money handed over to a fraudster won’t grow and won’t likely be recouped. So before committing any money to an investment opportunity, use the “Check Out Your Investment Professional” search tool below the calculator to find out if you’re dealing with a registered investment professional. Financials institutions vary in terms of their compounding rate requency - daily, monthly, yearly, etc. Should you wish to work the interest due on a loan, you can use the loan calculator.

Want to see how much you interest you can earn? This compounding interest calculator shows how compounding can boost your savings over time. You can calculate based on daily, monthly, or yearly.

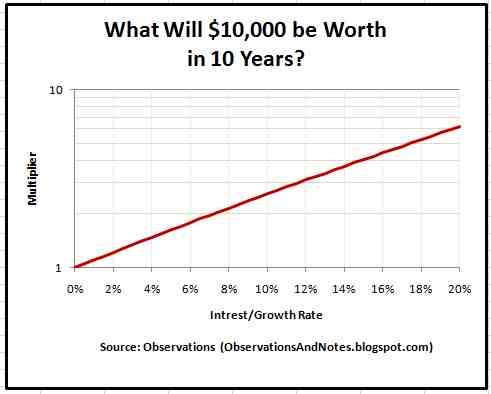

Calculate compound interest on an investment or savings. Using the compound interest formula, calculate principal plus interest or principal or rate or time. Includes compound interest formulas to find principal, interest rates or final investment value including continuous compounding A = Pe^rt. Quickly calculate the future value of your investments with our compound interest calculator. All data is tabled and graphed in an easy to understand format.

Free loan calculator to determine repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans, and bonds. Simple compound interest calculator. This calculator is not intended to be your sole source of information when making a financial decision.

You should consider whether you should get advice from a licensed financial adviser. Refer to the How compound interest works section at the bottom of the calculator for more detail. The easiest way to take advantage of compound interest is to start saving! What does compound interest formula mean? Our investment calculator helps you estimate your retirement savings and connect with an investing professional.

Use the best retirement calculator now! The simple savings calculator from Bankrate shows how your investment can grow based on initial and additional deposits, plus interest. Multiply the principal amount by one plus the annual interest rate to the power of the number of compound periods to get a combined figure for principal and compound interest. Subtract the principal if you want just the compound interest. Watch as your money grows by the miracle of compounding.

For this formula, P is the principal amount, r is the rate of interest per annum, n denotes the number of times in a year the interest gets compounde and t denotes the number of years. Chart the growth of your investments with our compound interest calculator. Control compounding frequency, add extra deposits, view charts and tabled data.

Savers can use these free online calculators to figure out how quickly their savings #128181; will grow. The below compound interest formulas are used in this calculator in the context of time value of money to find the total interest payable on a principal sum at certain rate of interest over a period of time with either monthly, quarterly, half-yearly or yearly compounding period or frequency.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.